Hey Friends — In this guide, I am going to tell you the easiest and most effective Denmark-specific investment plan for most people. Updated to 2025 .

I’ve built an investment portfolio of well over 1m kr in stocks and funds, and this is the exact setup I used. It will be especially relevant for those who want a set-it-and-forget approach but still want the most profit possible.

Denmark Disclaimer

Denmark is the worst place in the world to make money as an investor. It has the highest investment gains taxes in the world, and in many cases you pay taxes on your gains even if you never sell your investments – so called unrealized gains.

- Hence, my best tip investing tip would be: don’t live in Denmark.

- Harsh, but believe me – this is true. We’ll get to the specifics in a minute, but you could end up paying 42% on investments you never even sold.

- It’s brutal.

But alas you’re living here, you want to invest anyway, so let’s move on… I’ll tell you how to make it worth it, even in this context.

The One Good Investment in Denmark

Just to set the matter straight: if you want to build long-term wealth in Denmark, the best thing you can do is to buy the most expensive house you can afford and hope it goes up in value.

- In Denmark, properties are highly taxed while you own them, but the sale is tax-free so long as it’s your primary home.

- For example, I bought my apartment for 4,5m and now we’ve sold for almost 7,5m. That’s a 3 million kroner tax-free gain.

- We’d put down 1m kr, so literally we 4x’d that over a bit seven-years ish.

- To 4x your investments is not unheard of, especially over a long period – like, buy NVIDIA a few years ago, you know. But this is 4x net-net, tax free.

- If it were stocks, I would end up paying 42% of that 3m gain in taxes – leaving me less than 1,8m net net.

- This, of course, gets pumped up by leverage. The more expensive the place, the more money you can earn. I have friends who made a 5m kr. gain in 4 years. It’s nuts.

SO – We’ll talk about investments in stocks and funds and indexes, and I’ll tell you the best ways to do that in Denmark, but keep what I just told you in mind: in order to build long-term wealth in Denmark, the house is the way to go.

Denmark Investing – The Plan

OK – That said, let’s talk about stocks and investments. In here, our plan has to have two legs:

- First, you need to max out your tax-advantaged investment account. This is called Aktiesparekonto. You pay 17% tax on this one – BUT – on unrealized gains. I’ll explain in a minute.

- Second, you can open a normal ‘investment account’ and – setup your månedsopsparing – a monthly savings setup, so you can invest automatically every month and without fees. Taxes on this one go from 27% to 42%.

- THEN – Because Denmark’s tax rules are so complicated, you want to do this in a broker that will do all the taxes and reporting for you and do it for free. This means you do it via Nordnet, or Saxo (dedicated brokers) or via your bank like Nordea or Danske.

Maximize Your Aktiesparekonto

- Aktiesparekonto are special investment accounts where you pay only 17% in capital gains vs. 27 to 42% on the normal accounts.

- This means that if your stocks went up by 1000 kr, you’ll pay 170 kr in taxes, instead of 270 to 420 kr. (Yep, 420 kr out of a 100 kr gain in taxes. Ouch).

- So in this context, 17% is great – but the ASK have three catches:

- First – There’s a limit to how much capital you can add to your ASK. In 2025 that is 166.200 kr. If your account grows over that, great — but you can’t deposit more if you’re over that limit.

- For instance, today my Aktiesparekonto is a bit over 200K. That’s amazing, but it means I can’t add any more money.

- The investment ceiling has been going up over time though. It wasn’t long ago when the limit was 100K. We’ve come a long way.

- Second – In the ASKs, you get to pay taxes even if you don’t realize your gains. So, say you buy Apple stock and it goes up by 1000 kr. Even if you never sold that stock you’ll need to pay 17% of that 1000 kr gain at the end of the year. That sucks and that type of taxation is unique to Denmark but it’s still a better deal than the alternatives.

- Third – Because the ASK is such a Denmark-specific setup, it’s only Danish brokers like Nordnet, Saxo or Nordea etc that have this. You can’t open an ASK with Revolut or Degiro or eToro.

- First – There’s a limit to how much capital you can add to your ASK. In 2025 that is 166.200 kr. If your account grows over that, great — but you can’t deposit more if you’re over that limit.

- You can only have ONE Aktiesparekonto, just for reference.

- For the ASK, I recommend you buy stocks or funds that are on the more riskier end (i.e. more chance of profit). For instance, I have mostly tech stocks in my ASK as those have tended to perform best over the past years and I want to pay 17% vs. 27-42% on the gains.

- If you’ve not maxed out your ASK, all your investing kroner should go that way. Max it out ASAP. There’s no automatic buys in the ASK as there are for normal accounts but both Nordnet and Saxo have low fees for buying.

Setting Up Månedsopsparing

If you maxx’ed out the ASK, the next step is to setup your automatic investments.

- If you want your money to compound, you need to invest every month. Investing is a long game. I’ve invested from 10 to sometimes 50% of my take-home income every single month for years — and only now, years after, I can start to see big money.

- If you’ve 20K to spare, by all means — invest 20K a month. But, for most people, my recommendation is that you pick a number that is reasonable for you, that won’t hurt your lifestyle – if it’s 500 kr, or 1.000 kr – that’s fine.

- What you want to do here is to build the habit of investing — to frame yourself as “Yes, I’m an investor”.

- If you can, of course, go high – 5K-10K is a reasonable number for most expats in Denmark, for instance. But, again, you can start small and grow as you go along.

Then, Invest Automatically:

- I strong recommend you make your investments automatic. Specifically, what you want is a setup that:

- Each month, the day after your salary comes in, you’ve an automatic transfer from your bank account to your investment accounts. It takes one minute to setup that in Nordea or Danske, for instance.

- Then, you want your investment accounts also to invest automatically. Specifically, you want a setup that once the money comes to your brokers, it’s automatically used to buy a specific fund or stock you specified in advance.

- I recommend Nordnet for Stocks to do that, and more on that in a minute.

- The idea here is to invest without even thinking about it. (To have it as a process running in the background every month).

- I guarantee that if you don’t do it automatically you’ll either a) not do this every month, or b) spend way too much time thinking about it.

Making It Happen with Nordnet

SO – Once you maxed out your ASK, setup a Månedsopsparing Account in Nordnet or Saxo. This is an account that will do the auto investing we talked about — and I made a video explaining the setup linked above. It’s free to do this.

- I recommend most people to invest in index funds and don’t bother with picking stocks. Index funds have low fees and regularly beat even the fanciest investors.

- Specifically, go with funds that cover a wide set of the markets – e.g. the top 500 Stocks in the US, Top 1000 worldwide, etc.

- Taxes for this are complicated. In short, you’ll pay 27% for the first 67,5K you’ve in gains and 42% on everything over that. There are no loopholes.

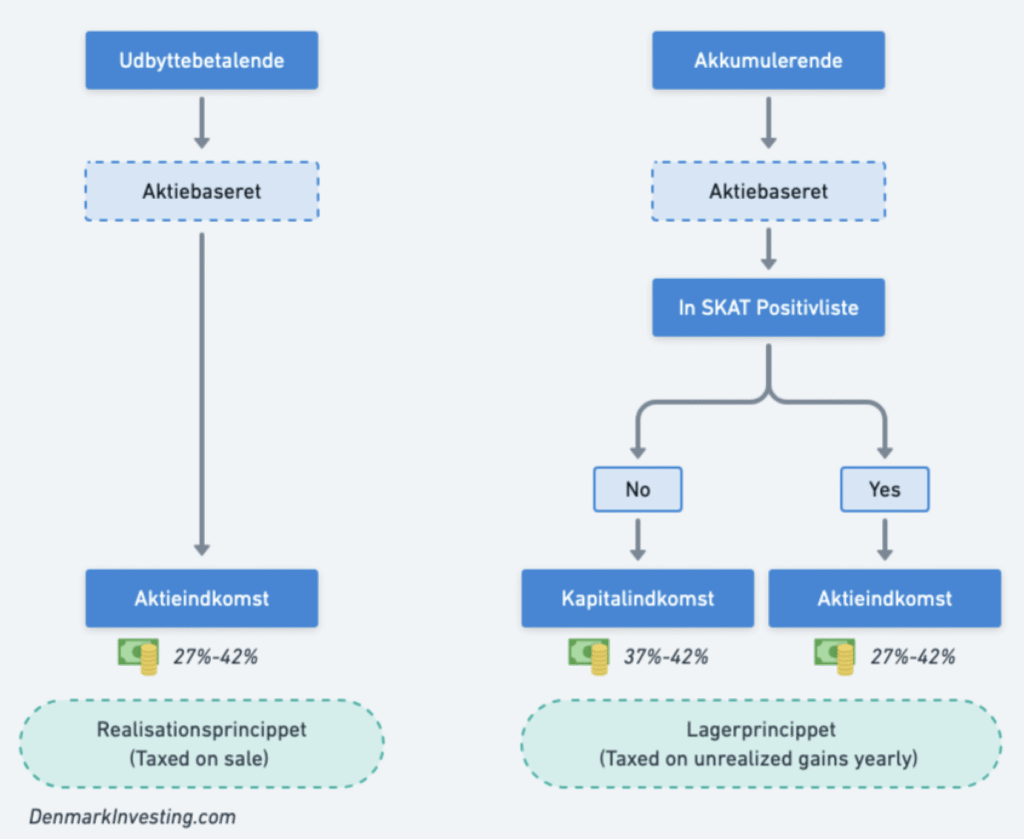

- But, be aware, because it’s Denmark, you’ll also pay unrealized gains on most of your index funds each year. I made a graphic you can see here and start to get confused about all the rules.

- Still, all things considered, this is the best option.

Keep in mind, you can’t do MO for the ASK. That one you max out manually.

Riding It Out

When you get this up and running, you’ll be like me, who turned my regular investments into a nice million kr.

I’m though closing most of my investments – just keeping the Aktiesparekonto – because we just bought a townhouse here in the city and need to put an enormous downpayment…