Hi, I’m Mario Scian 👋🏻

I’ve spent hundreds of hours learning and researching about buying an apartment in Denmark.

If you’re an expat in Denmark, this guide will be the best resource in the internet to help you find your next home and pay the best price for it.

My Background & Why You Can Trust Me

I’m from Argentina and I’ve been living in Copenhagen for more than ten years. I work in Maersk, where I’m buying things professionally — think of ports, ships, fleets of trucks, etc. Big things.

I bought my first apartment in Copenhagen in 2017. (And then a townhouse in 2025 🎉!)

I’m obsessed with the details, and there are a ton to look into: laws and lawyers, financing and interest rates, taxes and fees, a crazy-fast real estate market.

I spent hundreds of hours looking through all that. I met lawyers, realtors, all major banks, and a multitude of advisors. I spent months learning about the real estate market and visited dozens of apartments.

All the way, I wished there was *one* guide that would outline everything I needed to know.

I could never find one — so, alas, here we are.

I wrote this monster, 40-page guide so you’ve it easier than I did. I wrote it so you save time and get straight to what you want — to get that new apartment.

It’s all free, no strings attached. No catch.

Who This is For 👇🏻

- This is a guide for foreigners in Denmark. There are rules for Danes and for everyone else. In this guide, I focus on everyone else.

- This is a guide to buy an ejer property. I barely touch on andels. For summer houses, I made a separate guide.

- This is primarily a Copenhagen-guide. That’s where I’ve been living. Still, I would assume that most of this will also apply in Arhus, Odense and beyond.

This is not a guide for Danes (though it can help you if you’re one), nor a guide on buying property elsewhere in Europe.

Disclaimer — If you’re serious about buying an apartment, you should talk through all the relevant details with your legal and financial advisors. This guide is for informational and entertainment purposes only. I don’t take any responsibility for you bidding on any property.

Before We Start — Know What You’re Doing 🚨

With that said, a few words of advise:

- Buying a property will be in most cases the biggest purchase of your life. You need to know what you’re doing, and that’s where this guide will help.

- Buying a property is not necessarily a good investment. People have been conditioned to think that buying a house is an excellent financial decision — in the majority of the cases, it’s not. An apartment can be a liability, especially if you buy high and have the wrong mortgages.

- Properties are illiquid assets. They’re expensive and hard to sell. It’s risky to tie the majority of you net worth in an asset like an apartment.

Still, if you do it right, you can look forward to have more money in your pocket each and every month, and a big pay day when you sell.

Index — How This Guide is Structured 🧭

The guide is divided into three sections:

First, you’ll get an overview of the housing market in Denmark. Specifically — you’ll see whether it’s a good time to buy or not, which are the rules and laws you should know, and the types of financing available.

Second, you’ll look into the how to find the “right” apartment. Specifically — what are the right locations, what are fair square meter prices, what is the “ejerudgift” and all the relevant information you should take into consideration.

Third, you’ll learn what you need to start bidding for properties, and how to negotiate the lowest purchase price possible.

⚡️ Do you want to save this guide, and get unlimited access for later? You must click here to get free access to the guide and ALL my resources (videos, Q&As, etc.).

🍵 Part I — The Danish Housing Market — Overview: Should You Buy NOW in 2025?

Straight-on, my take is:

- Yes – It’s probably a good time to buy. I think that so long as the economy keeps strong, prices won’t go down. If you’re buying for the medium to long-term, go for it.

- …and, for context, I say this with skin in the game. I bought townhouse in Copenhagen in February of 2025. (So, that’s the second property I buy here already).

That said, the future is always full of uncertainties. There’s a trade war heating up, geopolitical uncertainty and looks like there’s chaos everywhere. It’s never clear cut.

But I’ve a lot of confidence in the market now that we’d interest rates climbing and higher taxes kicking in and prices still went up.

For More Context

In Denmark in 2022 and 2023 we’ve seen interest rates go up from 1% to between 5% and 6% (now down at around 4%), we’ve an unprecedented inflation and energy crisis, all while higher housing taxes kicked in in 2024 for apartments in the big cities…

All this happened and prices still went up. Hence, my simple recommendation is that if you plan to buy for the medium/long-term — so five years plus — go ahead.

BUT — If you’re looking into a shorter-time frame — e.g. you plan to live in Denmark for only the next 1–3 years, or you just want to speculate — then I would be a bit more wary.

In all cases, don’t be emotional and search for a great deal. In down markets you can have incredible opportunities — and that’s what I’ll help you find and capitalize on in this guide!

🇩🇰 To get my most up-to-date analysis and (if you want) get feedback from me personally, again click here.

The Case for Denmark — The Fundamentals

In all cases, I write “buy for the long term”, and that’s because the fundamentals in Denmark remain strong:

This as historically — across the board — house prices have risen, at least in nominal terms. Prices can crash tomorrow (or in 3 years), but it’s very likely they’ll go up again over the longer term.

Still, this is just my opinion. It’s not a sure bet — we can’t predict the future, and trying to do so is risky at best.

The Objective View

Up to now, I’ve been generalizing. If you should buy or not will depend on your specific case. However, if you look at the data, it might be a smart move:

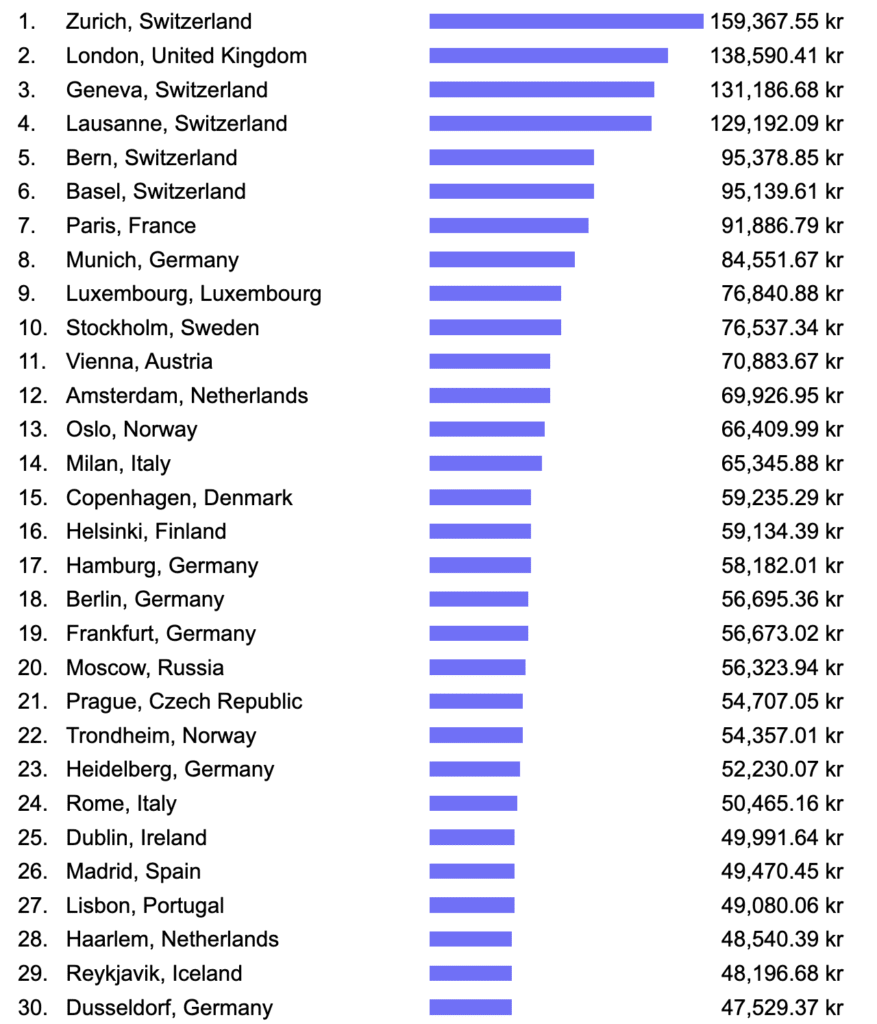

First — Copenhagen is not too expensive relative to other major European cities, as you can see in the below price per sqm meter in central locations:

Second — For the EU (and the developing world), high interest rates are unsustainable. It’s a matter of time for rates to come down, or, even, until the European Central Bank starts “printing” money via QE again. Once tat happens, all that cash will — again — flow to drive asset prices — all assets — up in value.

Third — If the alternative is to pay a high rent — as it is for most people — it is likely that you can get a cheaper deal on a per-month basis by buying. This, of course, will depend on how high your rent was and to what type of loans you’ll get access to.

🌀 What Should You Know About the Danish Market?

OK — Now we move from the realms of speculation to the actuals:

First — Denmark has a lot of cheap, subsidized social housing. If you can rent a social apartment, you’ll have a better deal than buying one. There are waiting lists and all that, but, if you do get a subsidized apartment, you’ll pay so little in rent that you’ll have plenty of leftover cash to invest in more liquid and higher-performing assets than real estate.

Second — Denmark is a very competitive real estate market, especially at the lower-end. If you’re looking to buy a 1 to 3 million DKK property, you’ll have a lot of competition in normal times. This will make you pretty “powerless” — and, because of that, you’ll struggle to get a good deal. The reason for all this is that the entry barriers are very low — loans are normally very cheap, and banks only require 5% of the value of the property as a down payment.

Third and Most Important — There is “discrimination” against foreigners in the Danish real estate market. For this one, let me elaborate:

- If you’re not Danish — and even if you’re a European Union citizen, mind — banks and advisors won’t treat you in the same way as if you were a Dane. You won’t get the same deals.

- Specifically, you might need to put higher down payments (not 5%, like a Dane — but 10%, or 15%, or sometimes more), you might not get offered specific loans (e.g. “no repayments”, yearly updated interest), and you might not be able to borrow as much as a Dane.

This is not an opinion — is a fact. I’m EU citizen, and so is my wife. We both have good, well-paid jobs in Maersk, and had enough capital to put 20% as a down payment for most properties. Still, despite all this, one bank didn’t want to give us a “no repayments” loan and access to the most flexible and riskier products.

It’s not like this always, but I’ve heard the same stories from almost all my foreign friends. The only way around this is to meet more banks and more advisors. Some are just too conservative.

There’s a rationale for this anti-foreigner bias though. Banks are afraid that — if all goes to hell, say, with prices crashing 50% — you’ll foreclose your apartment, default and move back to your country — leaving the bank with the house in negative equity and wishing them “good luck”.

Danes technically can’t do that, but if you as a foreigner do, the bank will be pretty powerless to prosecute you once you leave the country.

+ Besides all this, there are specific laws that “discriminate” against non-Danes, and participating in auctions can also be complicated if you’re not a Danish citizen. More on this, in the next section.

Rules / Laws You Need to Know — Before You Even Start Looking! 📚

There’s a multitude of housing-related rules and laws in Denmark and most are very complex. Here’s the rundown of the most important ones:

Ejer vs. Andels — Definitions

There are two major types of apartments/houses in Denmark — “Ejer” and “Andel”.

For “Ejers”:

- You’re the owner of the flat, and, similar to in other countries, you pay for joint expenses as cleaning of the halls, the vicevaerten (“house master”), garbage removal, building insurance, etc. to an owners’ association called the “ejerforening”.

- As it’s your apartment, you can do what you want with it. You can rent it out, do Airbnb, add and remove walls, and do all sorts of stuff that would be normal in every other country.

- Still, there are some rules set by the ejerforening — for example, you can’t change the outside/facade of your apartment, and you can’t turn the place into a heavy metal band rehearsal studio.

- If you buy an Ejer, you can get all the cheap and fancy loans.

For “Andels”, things are different:

- For Andels, you’re not the full owner of the flat — you’re are an “investor” or shareholder in an association that owns the building.

- As you’re not the “owner”, you give up power and control to the association. Andels have a lot more rules and regulations, and they’re often very strict.

- For example, you can’t rent out your andel — or, if you’re able to, you can only do so at a fixed, low price and for a set period of time, and only after receiving approval from the association.

- You’re also not allowed to set the selling price, if you decide to move out. Instead, the selling price is fixed by the association.

- On top of the regulations, the running costs for andels are usually much higher than for the ejers — both the joint expenses to the association and the loans to buy the andels are more expensive than for ejers.

- In andels, as so much depends on the association, the financial situation of the building will play a big part in outlining whether buying the flat is a good deal or not.

This looks gloomy, right? But, andels have one thing in their favor — the buy-in price is often much lower than for en ejer. There’s also, because of all the above, good and bad andels — but the best andels have a waiting list and are hard to “catch”. (It helps to have friends inside the good andels, ready to help you jump that list.)

Should You Buy Andels?

Because of this, I didn’t buy an andels and I researched and prepared to buy an ejer instead. The rest of the guide is ejer-specific.

The Other Rules You Should Know

To Buy and Sell:

- Down Payment Requirements. You need minimum 5% of the purchase price to buy a property. That’s by law. For foreigners, the banks can and often will ask for more.

- Loan Multiplier. Banks won’t loan you more than 4x times your yearly gross (pre-tax) salary. If you want to buy something that costs more than 4x times your income, you need to put in a very big downpayment. Banks used to be more generous, but the government has since made this more constrained.

- Capital Gains. Let’s say you bought your apartment for 3m. If you would sell it for 5m, you’ll have a capital gain of 2m. In Denmark, this gain is not taxed. Hard to believe, considering that Denmark is the highest-taxed country in the world and basically everything else is taxed (and very highly so). There’s a catch, though — you don’t pay capital gains if you’ve been living in the property you’re selling. If you bought, rented it out, and then sold, you’ll need to pay 35% of the gain or more to Skat.

- Living-Needed Apartments. In Denmark, there’s something called bopælspligt. If you’re apartment has this — and 99% of them do — it means that the apartment can’t be empty for more than six months. You’re thus obliged by law to rent out your apartment if it’s empty.

- The 5-Year Rule for Foreigners. If you’re not a EU/EEA citizen, you need to get permission from the Danish Ministry of Justice to buy a property (your lawyer will usually handle this). Then, even if you’re a EU/EEA citizen (and of course, for all other non-Danes), you’re still bound to the 5-Year Rule. This is: if you buy a property before living in DK for five full years, and you then you move out (for whatever reason) out of the country, you’ll then be obliged to sell the property within six months. You can’t keep it. If the market had just crashed at that time — tough luck, but you need to sell anyway. (If you bought after three years in Denmark, but have now lived in the country for more than five, this requirement is waived. You’re good.)

To Rent:

- Rent Control. There’s rent control for most properties in Denmark. This means that you can’t rent your apartment for more than a specific set amount, which depends on your kommune, on the size of the property, and on whether the place is furnished or not. In most places, this “controlled rent” is well below market price. If you’ve a big loan, this means that if you need to rent out your place to someone at the official rates you’re likely to lose money.

- You Can’t “Cheat” Rent Control. Or, technically, you can, but, if the tenant goes to the government “rental board” (an institution), and the rental board inspects the property on the tenant’s request and finds you’ve been charging more than you should by law, you will be obliged to: a) lower the tenants rent to the “official” level, and b) pay the tenant back the difference between what you charged him/her and what the “official” level is for the accumulated time he/she has been living there.

Boom. I know friends that had to pay up — it’s nasty, and you can lose a ton of money.

Now — this rule doesn’t apply for apartments in buildings built after 1992. If you bought an apartment in a building built in, say, 2000, or in 2012, you’re allowed to rent it for as much as you want. (This opt-out doesn’t include renovations — it has to be a new building!)

- 2-Year Renter Rule. If someone has been renting your apartment for more than two years, you can’t kick them out anymore — and you can’t change the conditions of the contract (rent, etc.) either. So, technically, it’s possible that you might end up with someone paying rent-controlled prices in your apartment indefinitely and lose a gigantic sum of money in the process. (I guess you can sell, too).

You can only kick the tenant out if you moved in to the flat yourself — but need to give a one year notice. The best way to go around this, if it comes to it, is to a) rent your apartment to trusted people (friends, colleagues, etc., b) rent through a company, which will handle all the paperwork, and do so for one-year period or similar.

Important! As you can see, it can be very tricky to rent your apartment in DK — if you plan to do so, meet with a lawyer, tell him or her your specific objectives, and have him or her draft the rental agreement and give you specific instructions on how to protect you. Then follow the instructions to the detail.

Also! Careful with Denmark and Law Changes. Two things:

- Denmark is a small, generally homogeneous country. It’s much easier to change laws in a place like Denmark than in Italy or Mexico.

- Denmark is a very socialist, left-wing (in social matters, at least) country, with one of the most (if not the most) anti-foreigner representation in parliament of all the EU countries.

This can be a dangerous cocktail — e.g. if too many foreigners are making a good deal out of renting non-rent controlled apartments, it’s not a stretch that the government changes the laws and does it quickly.

Like, really — Denmark and Danes don’t like when someone is doing very well (or much better than the average), and I wouldn’t be surprised if they change the laws and taxes to “correct” things.

(Hopefully my fears are overblown, but, again, you’re doing the biggest purchase of your life — rather have the facts straight, right?)

Financing (Mortgage) Opportunities in Denmark 💰

What Loan Can You Get? The Danish System — 5/15/80

- 5% — To buy a property in Denmark, the minimum you need to put down (the down payment) is 5% of the purchase price. You can put more if you can or want, but you can’t put less. It needs to come from your capital — your savings, family money, etc.

- 15% — The next 15%, if not coming out of your pocket, can be put down by the bank — with a bank loan, which we’ll refer to as the “expensive loan”.

- 80% — The rest of the purchase — from 20% to 100% — can be financed via realkredit loans — the “cheap” loans, which are the ones getting the headlines for their negative interest rates.

If you’ve the money, you can put the 20% (5% + 15%) yourself, and avoid the expensive loan. You can even put more — 25%, 30%, 40%, but, with interest rates still relatively low, you might not want to do that.

Note — If you’re a foreigner, you’ll likely need to put more. In some cases, banks won’t loan you money even if you put 20% or even 25%, especially for “riskier” cases as a project purchase.

RealKredit Loans — All You Need to Know

This is where it gets exciting. In Denmark, you can get three types of mortgages / realkredit loans: fixed interest, variable interest and a mix of the two.

First — Fixed Interest. You can get a fixed-interest loan — say, of 2m DKK, with an interest rate fixed for 10, 20 or 30 years.

In 2025, the most common fixed loan is the 30 year loan with ~4% interest per year. If you get this loan, it means that the interest on your mortgage in 2040 will still be 4% even if the interest rates across the board rose to, say, 10%. If you want to cover your risk, this is a solid option.

This is rapidly changing. In 2018, this rate was 2%, and, for historical standards, 2% fixed is insanely low. In 2021 it was 1%, and going potentially down to even 0%.(Isn’t that just crazy?). Now in 2025 it’s 4%+ because of inflation — though lower than 5% in 2023 🤯.

You can always find the latest interest rate expectations here. (Via Nordea Bank)

Complicated Aside — Denmark’s mortgage system is special — these loans are not issued by banks, but are instead bonds — floating bonds — that are issued by credit institutes on your behalf. This means that the debt is not held by a specific bank for all its customers, but by (in theory) a diverse set of investors, which are usually pension funds, hedge funds, etc. This means that the loan itself — the interest on the bonds — can’t be negotiated, as it’s the market itself that prices mortgages.

These bonds are bought in the financial markets, and, because of that, they’re priced as per the financial markets. This means that, depending on the price of the 30 year 1% bond, for example, you might need to borrow more (or less) money when you set up the loan than what you originally needed.

(This is a bit complex — but, the short case is that when think you need to borrow 3m, you could get, for example, 3,1m in debt, because the prices of the 1% bonds are lower than par). You can see the updated bond prices here.)

Second — Variable Interest. I mentioned above, historically speaking, 2% is very, very low interest. But, if you’re talking about a few millions, even 2% is a lot. It’s 20.000 DKK per million, per year.

For those who can’t stomach that, there are variable-interest loans — fixed for 5 years, for 3 years, for 1 year, or variable per month. The interest on these loans — for all of them — is near or effectively zero. Thing is, each of these loans have a “reissuing” period, and, when that period is past, the interest rates update to what’s then the new market prices.

From 2016 to 2022, for example, the F5 — fixed for five years — interest rate was around 0% to 0,5%. This means that you paid, say, 1.500 DKK per million borrowed, per year. It’s absolutely crazy.

This also changed in 2025: F5 is around 2,5% right now. Better than the 4% fixed, though

So — if you got this loan in 2022, you would pay the same interest for 2023, 2024, 2025 and 2026. But when 2027 would come, your interest rate would update.

Third — Mix of the Fixed and Variable Interest. You don’t need to get just fixed or just variable — you can also get a combination of both. For example, if you borrow 3m for the realkredit loan, you can borrow 2m with interest rate fixed for 5 years, and 1m with a fixed rate for 30 years.

Is it worth it? I got this mixed combo, with a F5 0,15% and F30 for 2%. I got an effective interest of 0,76% — a 0,61% higher rate than the F5 (18.270 DKK per year per million), but, at the same time, I insured my tail risk —which came in handy now that interest rates went up!

Interest-only Loans. When you loan money, you’re required, over the loan period, to a) pay an interest on the loaned amount, and b) to repay the loan itself, this in installments. If you loan money for thirty years, each year you would need to pay 1/30th of the loan value back to the creditor, plus interest.

In Denmark, we’ve loans that let you skip b) for the first ten years — effectively making your loans only interest. You don’t need to worry about installments on the principle for a full decade.

While interest rates are very low, property prices are high — and, if you loan, for example, 3m DKK for thirty years, besides the interest, you would be supposed to pay back 100.000 DKK every year. Cashflow-wise, this can be a killer for most people. It’s a lot of money.

In this case, you would be building equity — it’s not that you’re “throwing away” your money. But, if it comes it, you would be tying a very high fraction of your net worth into just one asset. That’s risky.

If you, on the other hand, pay only interest, you’ve optionality. In life, especially when looking into the future — with all its uncertainty — the plan or setup that gives you the most options is often the best. If you get an interest-only loan, you can, if you want, still pay back installments on the loan itself. But you’re not obliged to do it.

If you get an interest-only loan, buying a place can be cheaper than renting out in the vast majority of cases. Also, you would’ve more money in your pocket every month. Cashflow. That’s what you want.

Had it not been for this rule, I would’ve not bought my apartment. This is what makes the deal good.

🤷♂️ OK — I wrote this section when interest rates were lower. If I would be paying 5%+ I would do the repayments. But the no-repayments setup is still an incredible opportunity to have on the table.

Cons? Catches? Two:

i) You (obviously) need to still pay back the principal, eventually. In the 3m loan case, after ten years, you will need to start paying 150.000 (not 100.000) DKK every year. If you’re staying at the same place, and with the same loan, the party is over. You could, though, renegotiate your loan — what deal you’ll get (good, bad, etc.) will depend on how interest rates look like right then and there.

ii) “No repayment” loans have slightly higher bidraggsats — more on this, below.

Note — Some banks are experimenting with loans with no repayments for 30 years. So technically, you’ll only pay interest, for the whole, full period. Many caveats apply. But it’s happening!

The Bidraggsats. If you were looking for the “zero interest” catch — here it is: the bidragssats. The bidragssats are fees, set by the banks, to make money off you even in you pay zero (or negative!) interest rate. For a fixed 30-year loan without repayments, this fee is 1% per year.

These fees are absolute bul****t. The banks have carteled and — as they can’t make money off us with high interest rates, they just raise these fees in concert. It’s ridiculous.

This means that even if the interest rate on your loan is 0,15%, your effective rate — what you’ll need to pay every year as “interest” — is around 1%. There’s no way around this. (Or, if you know a way around this, please let me know!)

How much bidragssats you’ll need to pay depends on four factors:

a) from which bank and credit institute you borrow — e.g. Jyske Bank are the cheapest, while Nykredit/Totalkredit are the most expensive.

b) how much of the value of the apartment you need to borrow — if you’ve capitalized (meaning, you’ve paid off) 50% of your apartment, the bidragssats is lower than if you only capitalized 20%. The more you’ve paid off your loan, the lower the bidragssats.

c) if you took repayments or no repayments — no repayments loans pay ~0,2% more per year.

d) what type of loan you get — the lower the interest, the higher the bidragssats, usually.

So don’t be fooled. Always ask the bank about the bidragssats. You really won’t pay 0%, 1% or 2% — ask banks for what is you real, actual rate.

Note — Banks have a measurement called ÅOP — this measurement includes: the interest rate, your bidraggsats, and the annualized percentage impact of your transaction costs.

You can see the different bidragssatser per credit institute here.

Bank Loans — The Expensive Loans

You can use these cheap loans — the realkredit loans — for only up to 80% of the value of the property. For the other 20%, you need to either self-finance, or ask for a bank loan — the “expensive loan”.

Regardless the case, you need to self-finance at least 5% of the purchase. Then, you can ask banks to loan you the difference between what you paid (minimum 5%) and 20%.

These loans are more expensive than the realkredit ones. You could expect to pay 3% to 10% per year depending on the bank and your risk profile.

Bank loans are usually for ten years max and you can’t get the “no repayment” deal. You need to pay back.

Contra-Catch. Still, bank loans not as bad as they’re made up to be. Unlike the realkredit loans, you can negotiate the interest rate. In this case, you can play banks against each other — if one offers you 3,5%, you can show another bank that offer, and ask them to match. Like this, slowly, you can get to interest rates that are around 3% — not the 5%, 6% or higher that banks will try to get you into first.

Also — These loans also don’t have bidragssats. This means that, if you’ve a fixed loan without repayments, you might pay — in effect — the same rate for the fixed loan and for the bank loan — ~3% on both cases.

Tax Deductions on Mortgages

In Denmark, you’re allowed to deduct 33% off the annual interest cost from your income taxes. This means that if your interest rate is 1,5% (including bidragssats), your effective — and now final interest rate will be 1%, as 1,5% * 66% = 1%.

You’ll still pay 1,5% to the bank. But you’ll get that 0,5% back as an effective post-taxes salary/income raise. If you’ve 3m in loan, this means that you would get 14.850 DKK back in taxes per year.

This is the difference between the “brutto” and “netto” monthly costs. Brutto are the costs before this deduction, and netto are the costs after the deduction. In the long run, this can sum up to a lot of money.

Note I — There have been talks about reducing this deduction from 33% to 25% — again, we’re at the mercy of the Danish laws here.

Note II — If you don’t pay taxes (for whatever reason), you won’t get this deduction, as it’s based on your income.

+ Important! It’s strongly — very strongly — suggested that you’ve your financing options approved by the bank before you start seriously looking for an apartment. It usually takes a few days minimum — but usually around a week, or more — to get your preferred loans pre-approved. If you’re in a bidding war or ready to make an offer, you want to have all this sorted out.

Also Note — Once you get an approval, the bank will issue a “Bank Guarantee”. This note specifies you’ve been pre-approved for a specific amount, and would normally be valid for a few months.

If You Enjoy This Guide So Far — You Will Enjoy A Ton of (Extra) Free Material 👇🏻

🔥 I’ve prepared two hours worth of in-depth videos, financial models and analyses, an exclusive Q&A with my lawyer and a lot more. You can get that for free plus unlimited access to this guide by following this link.

Part II — How to Find the Right Apartment 🏙

Alright, done with legalities — if you’re still reading, I trust you want to buy an apartment or house still. This part is more practical.

The Parameters / Variables to Focus On

There’s a whole set of parameters and variables relevant for property-hunting. For this guide, I’ll outline the most important ones:

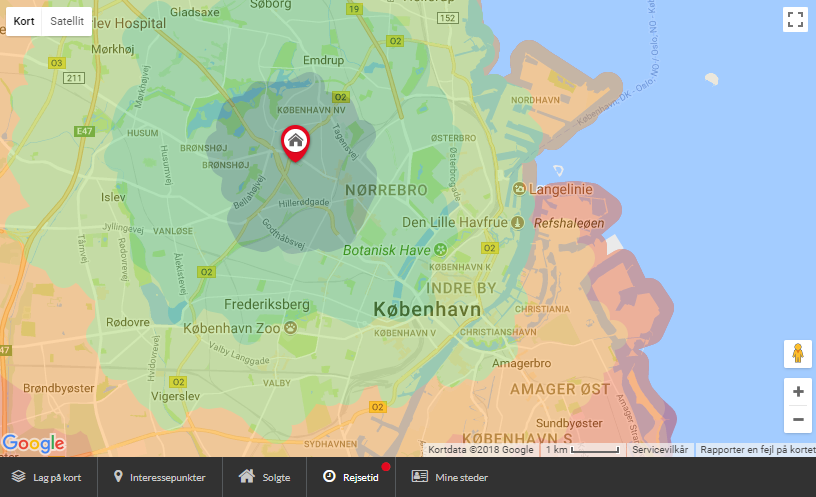

1) Location 🗺

In real estate, it’s all about “location, location, location”. If you’re willing to put literally millions down, the safest bet is to do it in a good location. In a place like Copenhagen, the following rules would apply:

The Suggested Must Haves

- Within a 10–15 min bike ride from the center (meaning, from Copenhagen K)

- Within 10 mins walk from the metro and/or other key public transportation

- Within 10–15 mins walk from major parks (Faelledparken, Frederiksberg Have, Amager Faelled)

- Well maintained / “clean” neighborhood (no crime, no vandalism, generally clean)

The Suggested Nice to Haves

- Real, solid water view — Nordhavn, Amager Strand, or, with a bit of less “punch”, side-ways facing canal flats (like Havneholmen, for example)

- Quiet street (specifically, not many cars)

Now, you can buy a place that doesn’t match these criteria and still be making a good deal.

But note — if and when prices correct (or outright crash), the better located ones maintain their value better than the others.

In all, unless you need the space, it’s been proven to be a better long term investment have a 10–20 sqm smaller flat in a good location than further out. This not just in Denmark, but the world over.

2) Size and Price, incl. Sqm Price 🏘

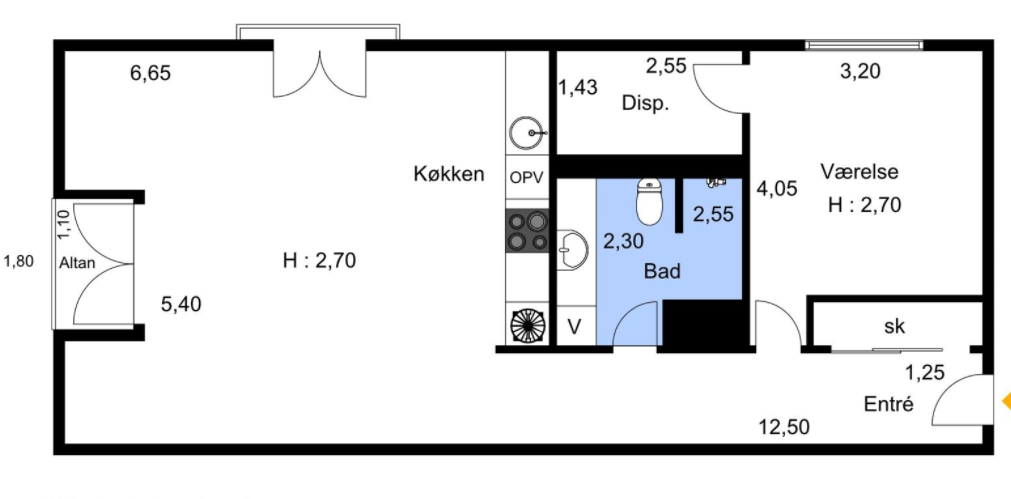

Important! The apartment sizes advertised in the main portals is not the real apartment size.

In Denmark, you’ve two ways to measure the size of a flat:

- BBR-boligareal: this is what you see in adverts (see above), in the realtors’ sites, etc. this measurement includes the apartment itself, but adds to the total your “share” of the corridors/hallways and common areas.

- Tinglyst areal: this is the “real” area — your apartment itself, including balconies, but no corridors and common areas. This is what you really get.

The difference between the two measurements can be big. I bought an apartment that is 102 sqm in tinglsyt area, but was advertised as 113m. In the building next to mine, an apartment sized exactly like mine — 102 sqm, with exactly the same layout — was advertised as 125m (!), all because it “owned” more of the corridor and basements.

These extra sqm are useless. You can’t, after all, put stuff on the corridor, nor send your visiting friends to sleep in the common areas. You’re paying extra for meters that you don’t need and can’t really use. Worst thing is you’ll be paying property taxes on those corridors and common areas.

Note — You should know that in many cases, even the tinglyst areal is incorrect and/or exaggerated — especially in older apartments. If you’re very interested in a specific place, your best bet is to measure the sizes yourself as well.

Armed with the real size knowledge, you can then calculate the actual sqm price. You calculate this by dividing the price of the apartment by the number of tinglyst sqm. The sqm price is the most important metric of this whole thing.

Apartments (less so houses), are priced per sqm. So, you want two things: a) minimize the sqm price relative to the city and neighborhood mean, and b) utilize the sqms in the most effective way possible

For a), note that there are many unimportant factors that can be included into the sqm price. For example, I used to work close to the Amerika Plads area in Nordhavn, and in the street I we’d the office, there are some apartments that have a little mini water view — like, very, very little, and with an ugly building on the other side of the small piece of water. Realtors still want to price it higher premium — for that.

For b),

- Look for apartments with small “entre” — ideally, the entrance to the apartment goes straight to the living room.

- Minimize corridors inside the flat — especially for apartments smaller than 100 sqm.

- Note that open kitchens, though fashionable, take a lot of space — which you could well use for an extra bedroom.

3) Ejerudgift 📨

After sqm price, this is the thing you should look into. It includes the per-month expenses you would be expected to have as owner of a property including:

- Ejedomsskat — one of the two property taxes, more on it below.

- Ejedomsvaerdiskat — the other property tax.

- Payments to the Ejerforening — this includes the payments to your owners’ association, covering things like: building maintenance, building cleaning (if applicable), joint electricity costs (corridor lightning, elevators) and building insurance.

- Grundfond — more payments to the ejerforening.

The ejerudgift, though, is not a “rent” — it’s a made up concept to illustrate how much you would pay, monthly, for all the above.

In reality, though, you’ll probably spend a lot more money in February than, for example, in March, as some bills are paid bi-annually and others quarterly.

Still, all equal, you want to find apartments with as low ejerudgift as possible. These costs will be fixed. If you’re stuck with a high ejerudgift, you’ll be stuck with high fixed costs. For 70–100 sqm, these costs should not be more than 4.500 DKK per month, if not much less.

If you pay more — and I do (!) — is because you get to live at a very high quality building, with quality maintenance and with big shared spaces, such as a big garden.

4) Other Important Parameters 📸

- Year Built. This is relevant for two things — a) if the building was built after 1992, you’re safe from rent control, and b) newer flats (not always, but mostly) are better built, better insulated, and are less likely to need costly repair and maintenance.

- Floor (etage). In Denmark, you’re expected to pay 50.000–100.000 DKK more per each floor you go up, depending on the flat. Thus, if a ground floor flat costs 3m, a third floor flat can cost 3,3m, all things equal.

Note I — Most people filter out ground and first floor apartments from their search, so note that — though cheaper — these flats tend to take longer to sell.

Note II — The higher-up flats are more expensive for a few reasons — a) they’ve better views, b) they (normally) get more sunshine, and c) they’re perceived to be “safer” by most people.

- Energy Mark. All properties are marked with a letter — A, B, C, D, etc. The earlier the letter is in the alphabet, the better the energy mark of the apartment is.

An apartment with an “A” for energy mark is expected to have low heating costs, fantastic insulation and a good electric setup. Similarly sized properties with an “E” or “F” are expected to have much higher running costs — often up to thousands of DKK per year higher.

This can be a big deal — in our cold weather up here, you can save a huge amount by making a big jump e.g. from C to A, or from D to B. I even noticed a big difference jumping from C to B.

You can find more about the energy mark here.

- Liggettid. This is a measure of how long the property has been out for sale. Based on this number, you can get some insights on high the real estate demand is. The average in Copenhagen, depending on the area, is between 60–100 days for the generic flat.

If the property has been on sale for longer than that, there are two things you should note: a) you can likely ask for a price reduction, but b) maybe (and honestly, just maybe) there’s something “wrong” about the apartment that it’s hard to see.

The best deals are gone pretty quick in Denmark, so be wary about properties that have been out there for too long.

The Apartment “Letter”, Screencast

If you’re interested in an apartment, you should get the “apartment letter” (salgsopstilling) and you can do so directly from the realtors. You’ll likely need to share your email or phone to get it — and, if you do, expect to get a call from the sales rep. Still, it’s a valuable resource.

📹 I made a video going through one of these sheets, I can send you the link by email if you follow this link.

In this letter, you’ll get a trove of information:

- The tinglyst area (the “real” one, from above)

- The breakdown of the ejerudgift and the taxes

- The previous year’s heating and water costs

- The expected transaction costs

- The list of white goods included in the purchase price

- The actual owner’s loans (if any)

- The specifics of the zoning of the apartment

- The list of documents and plans you can request (e.g. the maintenance schedule from the ejerforening, the minutes of the last ejerforening meetings, etc.)

Lots of gold. I’ll touch on this below, but the beauty of the Danish market is how transparent it is. If you take time to dig in and compare data, you can be better prepared to pay the right prices.

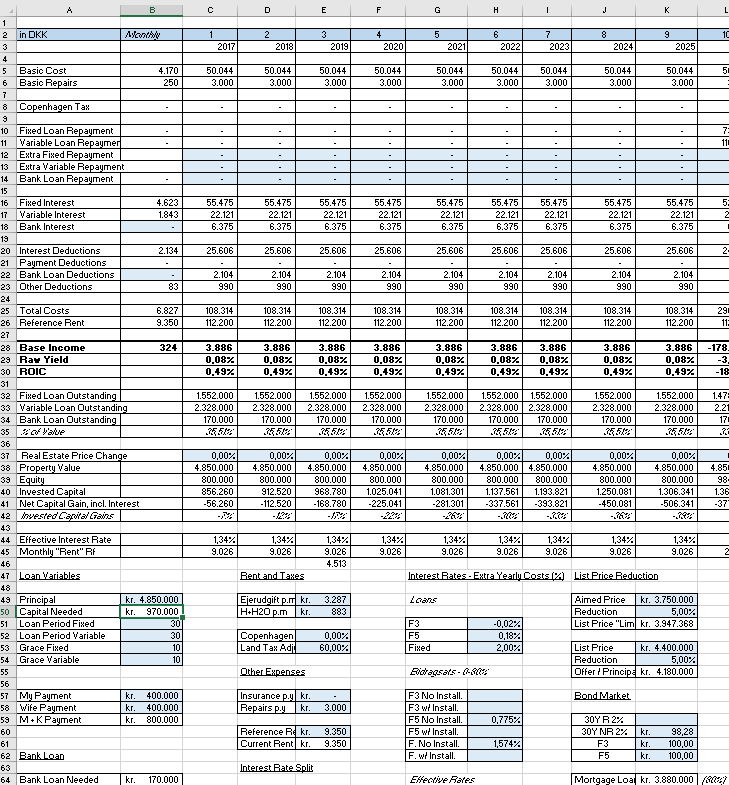

Constructing Your Cost Model 📊

My bias — I’m a conservative guy when it comes to investment. I keep most of my portfolio in safe assets, while having a fringe with very speculative ones. Not much in between.

Armed with all the above data, you should be able to sketch a cost model. The cost model is a spreadsheet where you can put the different variables (ejerudgift, purchase price, interest rates, your down payments, etc.) and get a specific figure for the total monthly or yearly cost.

Note — If you go to a bank, they’ll do this for you. But they’ll do it for one specific apartment, or at least only for the apartments you ask them to do it for. If you want to do this for all the apartments you’re potentially interested — dozens, maybe — it helps to build your own cost model.

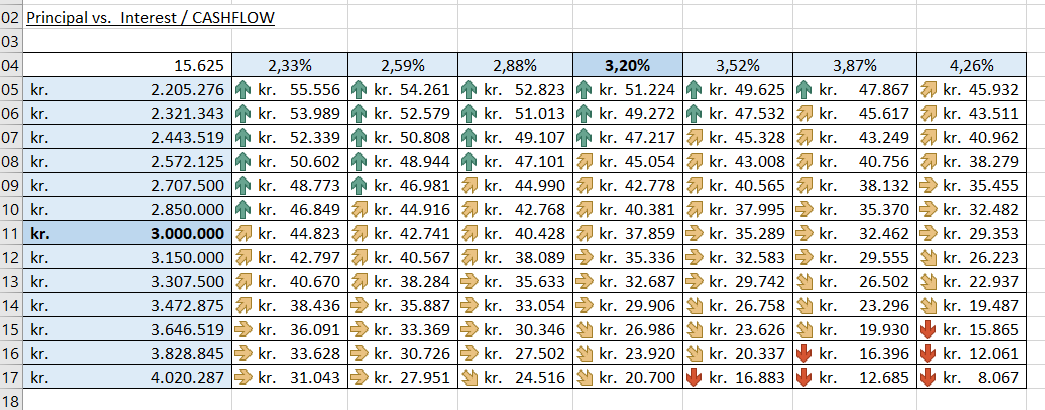

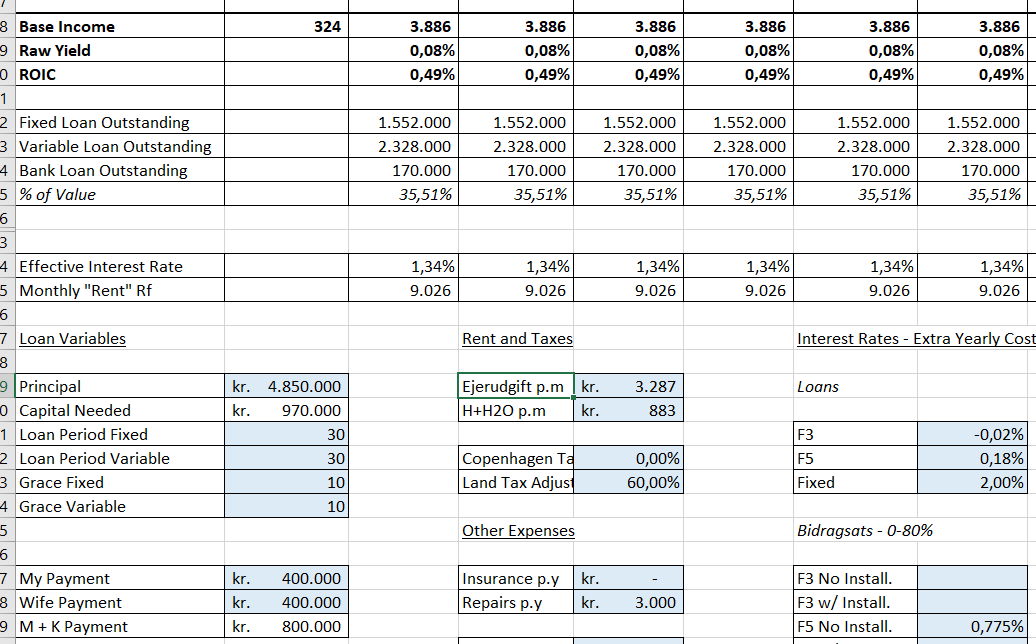

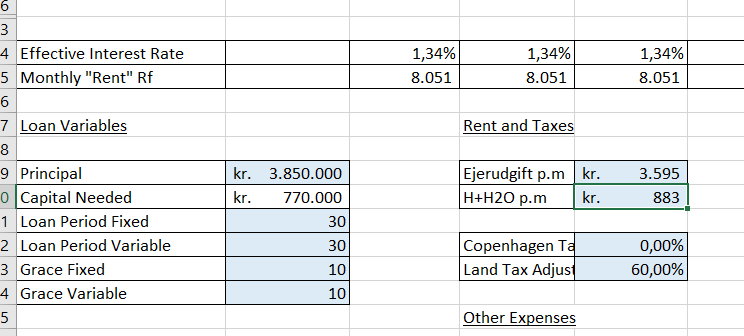

I took a couple of weeks to sketch one for myself — it looks as below:

There are some interesting things you can do if you’ve your own model:

I went ballistic. My model includes:

- Purchase price and downpayments split between two people

- Loan choice — repayments, no repayments, fixed, variable, etc., plus 5 year, 20 year, 30 year loans

- Bank loans and “one off” unscheduled repayments

- “Extra Repayment” for fixed loans based on bond-market price

- Effective/real interest rate, including the hated bidraggsats

- Ejerudgifts, water and heating

- Transaction and moving in costs

- Net worth and personal equity changes in case the price of the property goes up (or down)

💌 Do you want access to this model and know exactly how much you’ll pay once you move to your future home? You can get access to this model and detailed step-by-step instructions only here.

💳 The Key is Cashflow

I mentioned above, the key here is cashflow. If you buy a place now, how much more (or less) money will you have in your pocket at the end of the month? That’s what you should be focusing on.

Based on the model, you should know how much that cashflow will be depending on the price of the apartment, the operating expenses, the interest rates you can get, and so on.

It can be, for example, that a 4m DKK apartment will cost you less per month than a 3m DKK one, because of lower ejerudgift, or the heating expenses, or because of the loan mix you get. You’ll only know once you crunch in all the numbers.

Know How Much You’re Willing to Pay

- You need to know how much are you willing to spend as cashflow — are you willing to pay 11.000 DKK per month, or 15.000 DKK per month? The apartment price will be just one more variable in that calculation.

- Once you’ve clearly defined how much are you willing to spend, stick to it. Don’t buy a property that will cost you more than you can or should afford. Don’t buy emotionally. Buy with your head.

There’s no “perfect” apartment. If you fixate on one specific property, you’ll get a bad deal. So don’t get obsessed with one apartment.

If you’re ready to buy, you need to have two or three options at minimum. There are thousands of properties out there — and, if it’s your biggest purchase ever, you better do a good decision.

✉️ Again, you can get access to this model, detailed step-by-step instructions and a ton more here.

Buying / Bidding for a Property

If you’ve your model, you know the laws, and you’ve the financing in place, you can start bidding. The buying process as a whole looks like this:

Find Apartments, Visit Apartments — Bid — Sign Kobsaftale — Lawyer + Bank Approval — Tilslysning — Loans Setup — Moving.

1 — Get a Bank Guarantee + Lawyer 👩🏼💼

Important — As mentioned above, get this before you start seriously looking for a flat. It can take time, and you want to only bid — and get hyped about — properties you would actually be able to purchase.

The Bank Meeting

Banks’ business is to give you loans. They want to give you loans — they need customers! Always keep that in mind. You may want their money, but they want you too. If you look like a decent person, banks will fight to get you as a client. Don’t settle for less.

Still, to sell yourself, you need to be a compelling customer — and this means: you need to make the bank feel you’ll pay off your loans: you won’t default. If you make this very clear, you’ll get the deals you want. To do this, you need to:

a) Show Connection to Denmark. You need to explain what is your connection to the country — why you came, how long you’ve been here, and what are your plans for the future.

As mentioned above, it’s harder to get the best deals if you’re a foreigner. But it’s possible. You need to make crystal clear you’ve a strong connection with Denmark. You need to make it clear that you don’t want to leave, and that you won’t leave if the market crashes.

Banks are afraid that you might just move back to your country, default and leave the property to them in case something bad happens. If you meet with them and do the meeting in Danish, that will also get you points.

b) Provide Your Financial Information. Banks will ask you for at least: your three last payslips, your last year’s SKAT report, your pension information, your latest bank statement (or screenshots of your account), details on other loans (if you’ve any) and a simple file outlining your monthly budget.

Be ready to share of all that. Based on this information, banks will make an assessment of whether you’re a safe customer to lend to or not. To make it easier for them, i) save up — meaning, have some good savings in your account, and ii) show that your monthly balance is positive and that you can save 10%, 20% or more of your salary each month.

Based on these two points, banks will define you in a specific way / profile, and how much you they’ll be able to lend you depends on this. Still, each bank will profile you differently — you’ll get from Danske Bank will be different from what you get offered by Lan & Spar.

What to Discuss and Negotiate with the Bank

- Purchase Price Approval. This is up to how expensive a property they’ll support you to buy — be it 2m, 3m, 5m DKK, etc. This will be calculated as a multiplier of your pre-tax income, usually ~4X. Depending on how much you’re willing to put as downpayment and how good you pitch, this multiplier could be higher or lower.

- Downpayment Needed. The minimum is 5%, but you’re likely to be asked more — 10%, 15%, and in some cases, the full 20% or even more, depending on your risk profile.

- Type of Loans. You want to be able to go for the “riskier” loans — F1, F3, F5, etc. and for the “no repayments” options. Clarify that all these are approved in advance. Some banks might be tight on this — but press on. This is super important.

- Bank Loan Interest. If you don’t have the 20%, you’ll need to borrow from the bank the difference between that 20% and what you put in. You can negotiate the interest rate on this. You should be able to get this down to ~3% if you’re aggressive negotiating and have a good profile.

- Bank Fees. There are fees the bank will charge you to setup the loans, to clear the transaction, etc. There are some of these fees that are non-negotiable (they’re taxes or payments to the state or some other regulatory entity), but the bank-specific ones (lånsagsgebyr, for example) can be waived by the bank. Ask them to do it.

- Bank Premium Status. You should ask for the “Premium” or equivalent membership. This means in practice: waiving of all internal and national fees, waiving of premium card fees (for example, you can get a Gold Mastercard/Visa, etc.), get travel insurance, and more.

If You Chose a Bank — Banks will ask for your “nem konto” (salary/main account in Denmark) to be in their bank to approve your loans. So if you’re currently a Nordea customer and want to buy an apartment with Jyske, you’ll need to transfer your salary account to Jyske. This is free and the banks will organize it for you. But keep it in mind — it will take time, and, if you’re set with a specific bank for financing the purchase, you might want to do the account switch before you start bidding.

Which Bank to Go?

There’s no “best” bank. It will all depend on what deal you’re able to negotiate with each bank. I switched from Danske Bank to Nordea to finance my purchase because Nordea offered me a better deal. (But I also have friends who switched from Nordea to Danske Bank for the same reason).

The best deal will depend from person to person, and be based on:

- What is your priority — one bank might offer higher purchase price approval but higher interest loan, and another one might offer a sweet deal but no Mastercard Gold cards…

- Who your bank contact / advisor is — some advisors will be super helpful, and some will not cave in for the interest or the conditions you want.

Your best bet, again, is to meet with at least three banks, and but ideally more. There’s too much money on the line not to be very thorough here.

🏦 This is SUPER important, so I made a full on add-on guide called The Ultimate Denmark Bank Negotiation Guide.

The Real Estate Lawyer

You’re very strongly recommended to get a lawyer (boligadvokat) to sign off the purchase. He/she will also give a helpful hand to understand all the legalities, guide you when to sign or not sign documents, and be your guide to the fine print.

The lawyer’s work in a house purchase is standardized and straight forward. You’ll have a few phone calls and emails with him or her before you start bidding and then while you bid. You’ll only meet face to face once you’ve a purchase agreement signed by the two parties. Then he or she will need to approve the purchase and organize the registration of the property change of ownership towards the Danish authorities.

Note — In Case You’ve Problems. If you’ve problems with the purchase, bad news, or something (unexpectedly) negative pops up, the lawyer will be able to cancel the purchase for you. This so long as it’s within a specific, usually short time frame, and once the lawyer has read all documents and met with you.

For all that, lawyers will ask you for a fee that’s around 10.000 DKK. In all cases, agree with the lawyer that there is no limit on the amount of hours he or she will work on your case.

Clarify the fee and conditions before you start working. Ideally, have it confirmed in writing — so you avoid trouble or discussions later on.

Also — The best way to know if you’ve a good lawyer is to give him or her a call. Ask 3–5 good, precise questions (on the laws, the process, etc.) and see what answer he or she comes with.

🎩 If you’re looking for a lawyer, I strongly recommend Poul Grotum — pg@vilsoe.dk or +45 3348 9070.

Poul is the lawyer l hired the two times (2017 and 2025) when I bought a place. I can vouch that he’s great— especially if you’re a foreigner. Wholeheartedly recommended!

2 — Find Interesting Apartments 💁🏼

I’ve shot a couple of videos — explaining step-by-step exactly how I searched for and found interesting properties.

I search through three useful websites:

- Boliga. This site has an ugly, outdated user interface, but it’s fast. I use it in “map mode”, and find useful the overview of traffic noise, sunlight and potential water problems.

- Boligsiden. This site looks better — it’s fancier, yet a bit slower. It has a great map to calculate commute (in mins), and can mark schools, sport facilities, supermarkets, etc. in the map.

When searching for a place, set the parameters that match/reflect your cost model. You should look for and note:

- Cost Model Input — Noise — Sunlight — Past Prices — Commuting and Metro Plans — Schools — Cutural Activities.

- Long Term Value. If the area has a lot of potential in three-five year, might be a good investment.

- Layouts (it’s personal — but make sure that the sqms are well used)

🦁 You can get the in-depth search videos with step-by-step explanations here.

(Tired of getting prompts to sign up by email? I save my best material — including videos and deep dives and market updates — only to email subscribers. It’s 100% free and it’s the way for me to add value directly to you. If you don’t find the email material worth it, you can unsubscribe at any time)

3 — Visit the Apartments 💼

If you’re interested in a property, go and see it in person. It’s easy to setup appointments with the realtors, and they’ll be keen to accommodate you and show you their portfolios.

Individual Visits vs. “Open House”

- If possible, do individual visits — you’ll get the full attention of the realtor and you’ll get to ask all the questions you want.

- If you’re serious about an apartment, don’t go to the “open house” — these type of visits are meant to put more pressure on you, as you’ll see more people that are (maybe) interested and get emotionally triggered in an easier way to place your bid

How to Do Visits

- Call / Email the realtor listed in the apartment ad and ask to go for a visit. If you’re in the area, try to batch 1–2 apartments more in the same visit.

- Take a Look — maintenance (floor, painting are common) — but what about mould, plastering, windows, etc.? What about the light, the quality of the building? Focus on the building as a whole, too. If the corridors and stairways and common areas look rusty and unkempt, you can bet that the “inside” of the apartment will be as well (even if you can’t see it).

- What to Ask the Realtor — why is the owner selling? (to know, but also to sense urgency), what is the maintenance plan for the building?

If you like the apartment, also Google the “House Name” (if it exists). For apartments built in the last 20 years, this is always something like “Jacobsen Hus”, or “Komandants Gaard”. That’s the name of the building itself.

I was interested in one specific property and, after Googling, I found out that they were planning a big renovation for the building (expensive one, that is!), so, though I went to see the apartment, I quickly backed off.

Second Visits

If you like an apartment and consider bidding, go to see it a second time. If possible, bring someone else with you — a partner (if he/she hasn’t seen it the first time), or a friend. Fresh eyes always help — they might spot something you’ve overlooked, be it in the building quality, or location, or more.

If you do a second visit, the realtors will be hyped up. There’s a high correlation between second visits and bids, so use this as an opportunity to extract more information from the realtor and, even, use it as a pre-negotiation. You could say/ask, for example:

- “[Realtor Name], I’m interested in this apartment. I want to bid. But the price is unrealistic. It’s out of touch. How much is the seller willing to really sell this apartment for?”

- “Did you’ve any previous bidders for this apartment? How much did they bid?”

- “I want to bid for this apartment. But I also don’t want to waste my or your time. Being realistic, what is the price the seller is actually looking for here?”

You might not get any feedback, but you might. Remember — the realtors are on the seller’s side, but their job is to sell the apartments. If you’re serious about bidding, they’ll work with you to convince the seller to lower their asking price and close the deal.

4 — Making Your Bids — Negotiation 101 👊🏻

- If it’s a sellers’ market, it’s going to be hard to get a good price. No way around it.

- I negotiate for a living. It’s my job — I buy big things. I’ve access to the some of the best negotiators in the world — like, guys who have negotiated deals worth multiple billion dollars. We still have a hard time in a situation like this.

Negotiation is all about leverage. If there are dozens of people interested in the same property, there’s no “Art of the Deal” that can help you get a 20% discount. The seller will just pick the buyer who offers the most money.

This doesn’t mean you shouldn’t push for a discount. Even in a red-hot sellers’ market there’s room for opportunity. In this line, three things are paramount:

a) The Higher the Price, the Less Competition. You’ll find the heaviest competition in flats worth under or around 3m DKK. These type of properties disappear quickly, especially if they’re well located. Then, the higher up you go, the less competition (usually). If the property is highly desirable, though, you’ll always get competition, regardless the price.

b) If You Only Like One Property, You’re Screwed. If you like two, three or more places you can play the sellers against each other. So build alternatives — both cheaper and more expensive. If the seller is inflexible, and the property has been for sale for more than a month, pressure him or her by mentioning properties you’re interested in, that have both lower and higher prices.

c) Look for “Desperate” Sellers. They’re hard to find, but, if the property has been for sale for more than a few months, it’s possible that the sellers have already moved out or bought something else. If that’s the case, they’ll be willing to offload the property faster, even if they get a worse deal.

In that line, two more “hat tips”:

- As the market is so transparent, you can see and estimate how much money the seller will make from the transaction vs. what they bought the apartment for. If they’re earning 2m DKK, they’ll still want that extra 100.000 — but they might be a little less aggressive than a person who needs that extra cash or loses money.

- Two of the highest expenses as a home owner — the property taxes and the costs to the owners association, are usually paid twice a year (In Jan — Feb and Jul — Aug). The owners will usually be more willing to sell to a worser deal before those dates.

🗻 Learn Pro-Level Negotiation Strategies and Tactics

During the last three years, I’ve negotiated deals worth over $800 million in total at work. Maersk buys big things, remember!

Armed with that knowledge and experience, I applied the same key strategies and tactics I use at work to the real estate market — and got a steep discount when I bought my flat. If you’re interested, I prepared a free, 30-min in-depth video with step-by-step instructions that could save you a ton of cash.

👉 You can get the video (free) here. 🍻

(Note — The video will stop being free, and go paid-only from next month on. Still free now.)

Key Information Available

Negotiation is an information game, and in Denmark, you’ve a lot of it to play with. The Danish real estate market is very transparent. Like, very!

The following is public information — meaning, anyone can see the following information:

- Previous Sales Prices. Is the seller making a profit, or losing money? (Everyone’s greedy, but more people just don’t want to “lose”.) You can see for how much was the property bought and sold for going back to 20 years or more.

- Time on Sale. (The “Liggetid”). The realtors advertise for how many days the property has been in the market for. The longer this time is, the more likely the seller is to negotiate. (Not always, though.)

- Price Adjustments. It’s common for properties to be put on sale for a higher price than the market. If very few people show interest and/or no bids are coming, realtors will adjust the price down — usually after a month of liggetid, but can happen as fast as a week after.

- Previous Time on Sale. If the property was for sale for 100 days and didn’t sell, that information will still be available. You’ll also see for what price the property was advertised.

- Comparable Apartments Close By. In a site like Bolighed you can see the size (in sqm) and other information about apartments that are not even for sale. You can see and scan the whole building, and, based on that, project whether an apartment in there will come up for sale or not.

- The Seller’s Loans. In the small booklet, you can see exactly what are the loans the seller has — with explicit details, too. You can see how much he or she owes, how much interest he or she pays, for how long he or she had the loans, and more. This is knowledge is a huge boon for the buyer.

Based on this, plus the ejerudgift and heating/water estimations, you can infer exactly what the seller has to pay every month for the apartment. That’s a very big deal.

The Negotiation Strategy 💶

Your negotiation strategy will depend on the property, on its competitiveness, and all the cocktail of information listed above. If it’s not a red-hot apartment and the seller is willing to balk down the price a bit, you can do the following:

- Low Ball First Offer. Offer ~8–12% less, if not even less, than the current asking price. The sweet spot is just 1 DKK more than the seller’s piss-off point. Don’t adorn your offer with justifications, threats, etc. Just write “My offer for X, is 3.000.000 DKK.”

Expect, though, to be rejected — receiving a reply with phrases such as “offer unrealistic”, “doesn’t correspond to the sqm price in this area”, “out of touch”. Expect, though, to get a counter-offer — and one that’s often lower than the seller would’ve normally given.

- Email Offers. Make your bids by email. Use the wording above, and make the offer time limited — e.g. valid for one or two days only. Also, align with your lawyer on a specific phrasing to cover your rear — e.g. “This offer is under the conditions that my lawyer and bank approve this purchase”.

- If the Offer is Rejected, Give a Call. The realtor might call you him/herself, though. Stress your disappointment in the counter-offer. Then, use the call to get information — for example, what other things are important for the seller: moving date, selling furniture, etc.

- Bid Again. Generally, you want to bid in smaller increments — if you go up 100.000 DKK from your first offer, you want the third bid to go up only by 75.000 DKK, etc. The seller will probably do the same, though.

- Along the Way — Don’t Do Threats. Don’t make “last offers” — if you do, you’ll put all the power in the hands of the seller to say yes or no. In a “sellers market” as it is in Denmark right now, it’s a losers’ game. If you do make a “last offer”, follow through — never raise from your last offer. If you raise, pros will play it against you later.

If you’re close to a realistic closing point, the realtor will tell you. Remember — realtors want to the deal to happen. If you’re very close, they’ll pressure the buyer. Realtors want their commision ASAP. Play to that.

In case you still have a difference, mention your disappointment and start bidding somewhere else.

You can also be aggressive including non-cash things into the deal. You could, for example, accept a higher than-expected price, but on the condition that the seller has to paint the apartment or grind the floors, or that the keys should be provided one month before the official moving date. It’s not always about only price.

Note — Don’t buy into all the realtors’ salesly b.s. During the negotiation, you’ll be told that “there’s someone coming for a second viewing in two days”, or “the seller is absolutely no in a rush, she prefers to wait for a better offer.” Don’t believe any of that. The realtors want to sell as fast as possible.

Note II — Don’t be emotional! Before you start a negotiation, tell yourself what is the absolute maximum you would be willing to pay. Then, if the seller doesn’t go under that, don’t buy. Really — don’t do it. Let it go and focus on another property. If you’re “flexible”, the realtors will notice it — and they’ll get every last penny off you.

Last Note — Don’t be an ass. Be tough, but always cordial and polite. You can express your disappointment without damaging your relationship with the realtor.

Want to deep-dive in Negotiation? Again, I have prepared a 30 min video you can access for free here. 🍻 (Plus, a ton of exclusive material — my very best. 5.000+ people have signed up!)

Once Your Bid Is Accepted

Once you’ve reached an agreement, both you and the seller will sign the sales contract (kobsaftale). Before you sign, you should make sure that there’s specific wording mentioning that both your lawyer and bank need to approve the purchase. This is standard practice and your lawyer will make sure that everything in is in place.

Once you’ve the papers signed, you’ll meet your lawyer in person. You’ll go through the document together, and also through any other relevant documentation — e.g. all the material from the ejerforening, etc.

It’s likely that the lawyer will then put some conditions for his or her approval — e.g. that you check that all heaters are working, that you make a mould-level test, etc. These are usually accepted and no deal breaker. If the seller wouldn’t accept conditions like this, take a step back — it could be that there’s something fishy.

Note! In case you change your mind, your lawyer can still cancel the purchase for that first week (or whatever you specified in the contract). Lawyers won’t like to do this, but, if you ask them, they’ll have the right to stop the purchase. You won’t need to pay any cancellation fee to the realtor.

Parallel to the lawyer, your bank will also have a say. The bank will need to:

a) approve the purchase — including all the relevant documents, and

b) quickly put a deposit money (which can be from your account, or one that you can loan from the bank) in the realtors’ account. This deposit is refundable if the deal doesn’t go through.

Once All Approvals Are in Place 🔑

When all the approvals go through, the purchase is completed. You’ll then arrange the other formalities:

Non-Bank Related

- Change of Ownership in the Kommune. This is called “Tilysnign af Skode” in Danish, and is the document specifying that you’re the new owner of the property. The lawyers organize this for you.

- Notifications to the Ejerforening. This to get introduced, to get to know your expected costs, etc. You’ll also meet some responsible from the building to measure the electricity meter and other relevant information.

- Keys Receiving. Then, last, you’ll receive the keys — and, from then on, be a proud home owner 🍾

Important Note! — Until the sale is completely final — that tilysning is signed by both parties, you receive the keys — you can still cancel the purchase. Canceling, though, will be expensive — 1% of the agreed purchase price. This is a lot, but there can be cases when it makes sense, right? Like, if you bought the apartment a week before Lehman Bros. collapsed back in 2008, you might want to do it 😉

Still Want More Information? Let’s Keep in Touch 👇🏻

⚡️ If you haven’t signed up by email yet, you can do so here. You’ll get unlimited access to this guide plus three-weeks worth of extra content, all free — cost models, negotiation deep-dive, lawyer Q&A, analysis videos and more. Over 5.000 people (!) have already signed up.

💌 If you sign up by email here we’ll be able to keep in touch. I read all my email.

If you don’t want — no problem. I hope that this guide has helped you out! 😁

One More Also — If you haven’t joined me on YouTube do it! I post videos weekly. You can also join me on Instagram! I have been to 140+ countries, so I’m sure you’ll see something interesting over there 😇

More of My Writing & My Little Store 🔥

I hope you like my writing! If you enjoyed this guide, you might like my two products:

- 🗺 Dream Home Denmark. This guide covers 90% of what I know — for the rest, you can check Dream Home Denmark. It’s a toolkit that includes hours of exclusive videos (i.e., videos not on YouTube), unlimited access to my Excel costs models, everything you ever need to know about Danish mortgages, 3+ hours of content specific on bank negotiations, input on niche topics (e.g., buying a project apartment) and much (much!) more. You can try Dream Home Denmark risk-free: use *this link*.

- 🏦 The Bank Negotiation Guide. The main challenge expats have is to get banks to approve them for the mortgage they want. I made a whole separate course (2+ hours worth of material) to give you the exact step-by-step approach you can use for success. You can purchase it *here*.

800+ people have bought these products since 2018 and absolutely love them. I’m biased but can’t recommend them enough! 😀

Conclusion 🚀

Buying an apartment is likely to be the biggest purchase of your life. For that, it helps to be as obsessed with the details as I was — the more you know about the laws, the financing options, the market and negotiating, the better deal you’ll be able to get.